Hello, and welcome to the 2023 report...

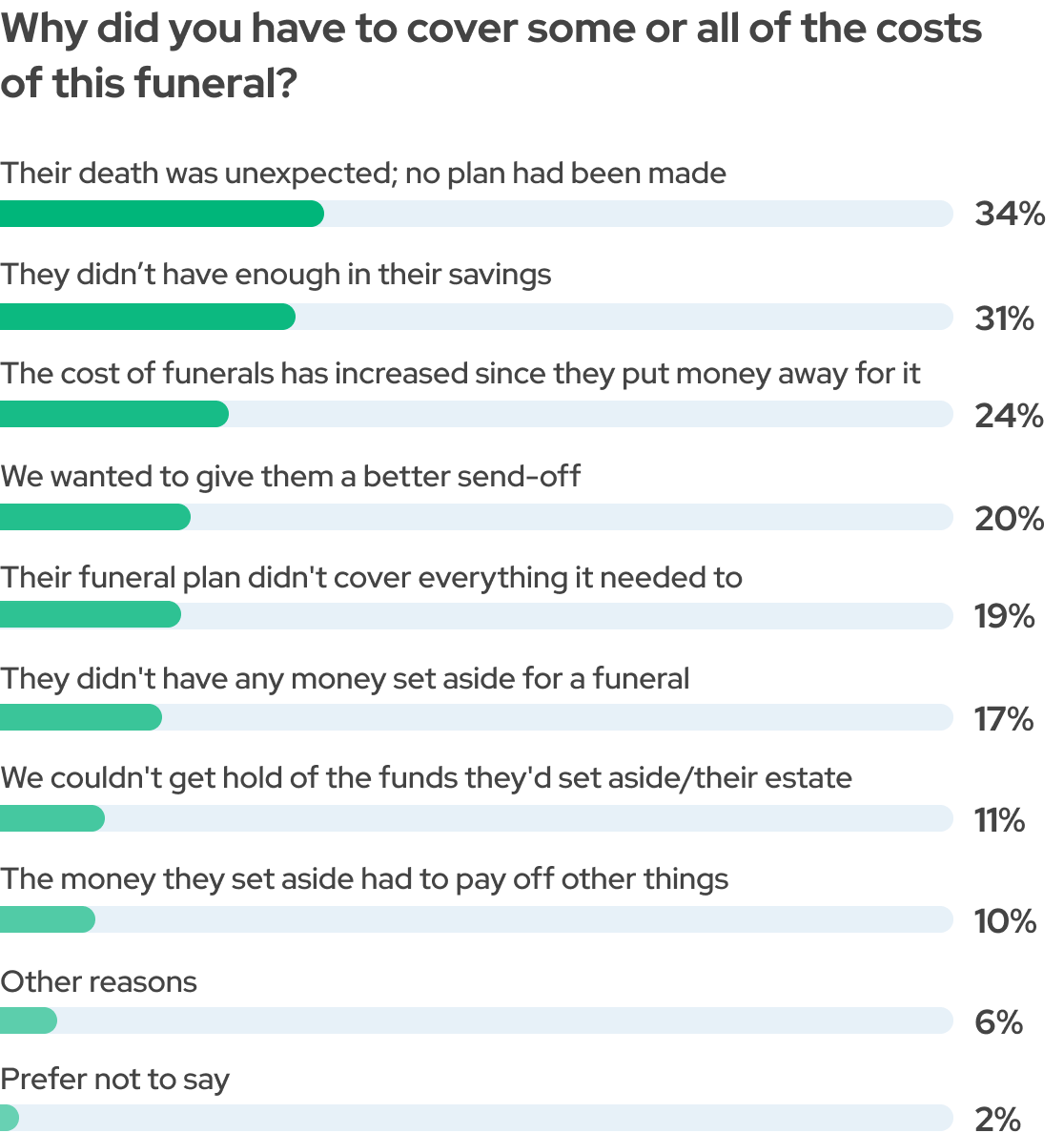

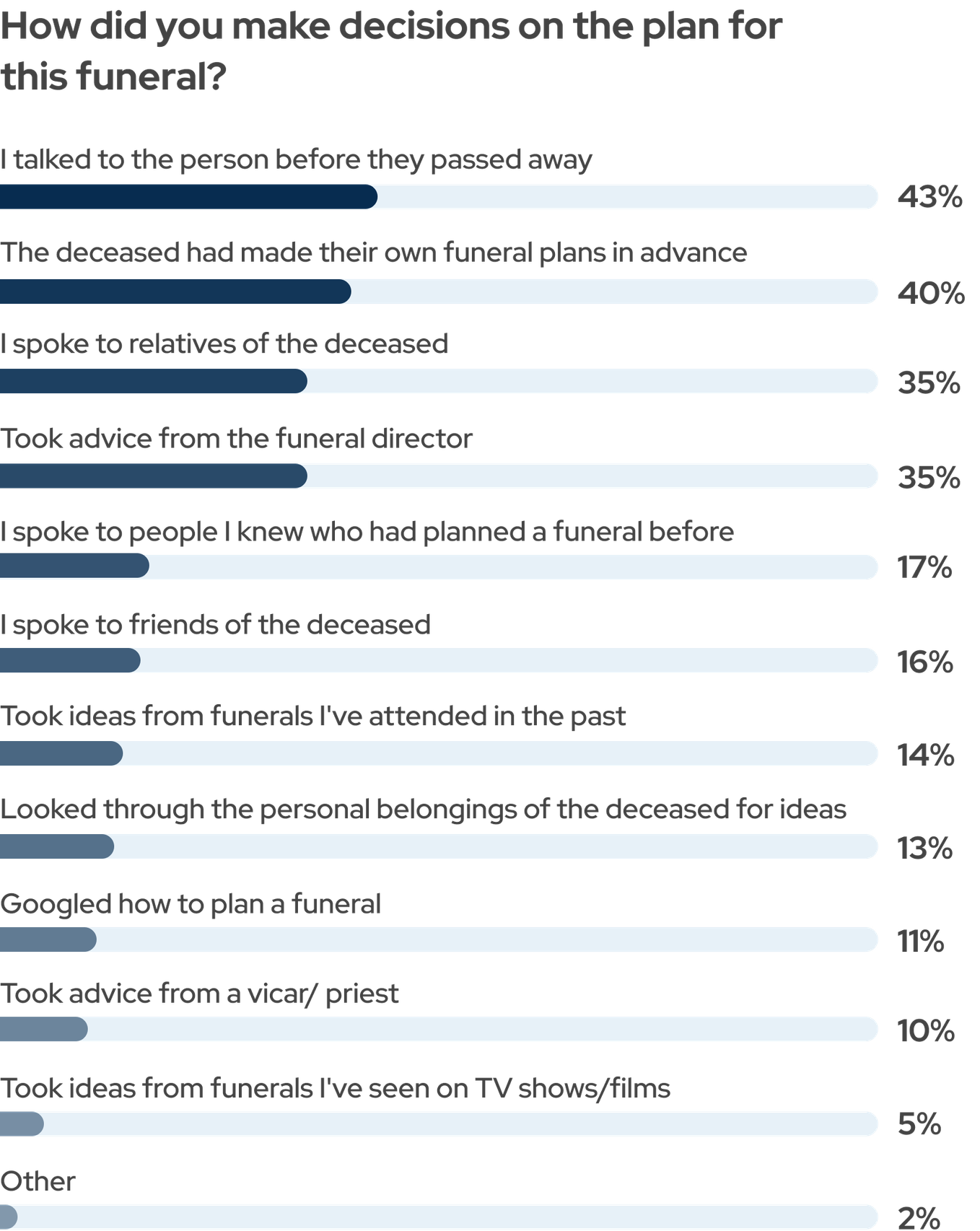

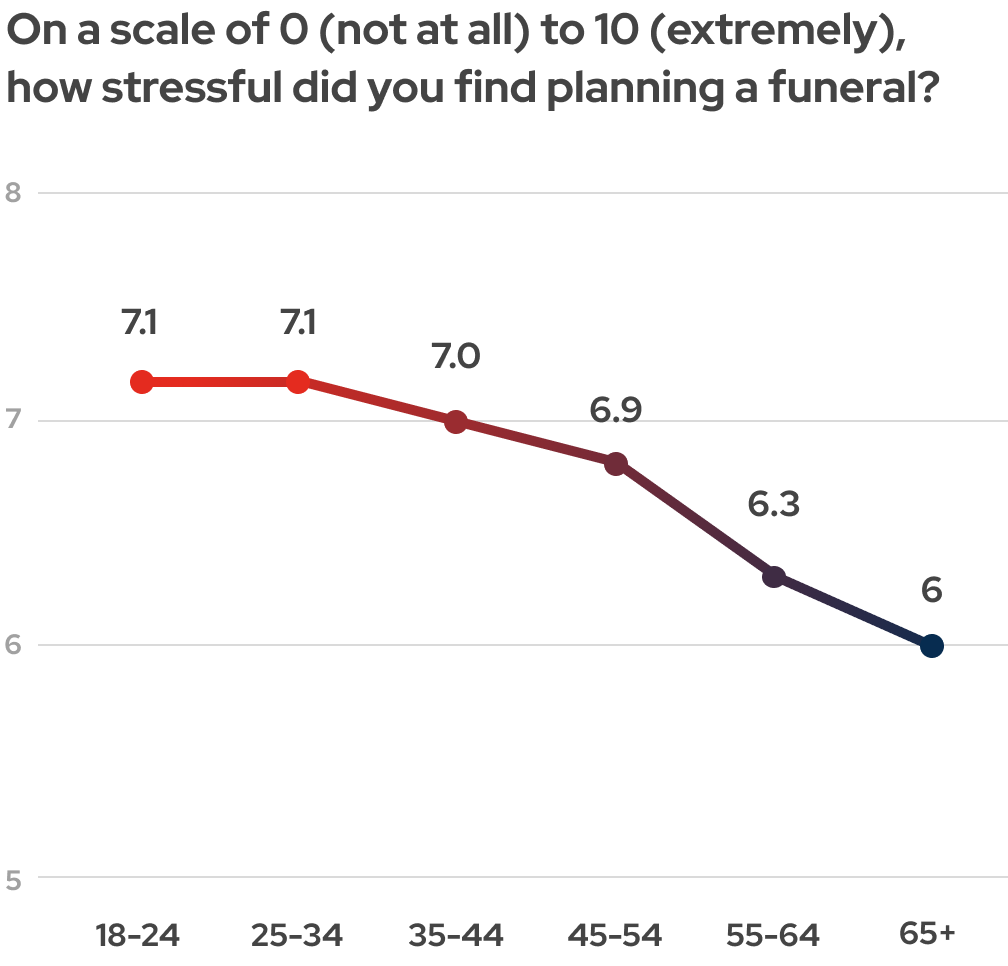

Coping with bereavement is hugely difficult and painful, particularly during the first few days and weeks following the death of a loved one. The last thing anyone wants to deal with during that time is another complex and expensive organisational challenge, but unfortunately that can be exactly what many bereaved people face as they try to organise a funeral for someone they have lost. Concerns about how to ensure that person is given a suitable farewell can become a terrible source of strain if no plans are in place to organise and pay for the funeral.

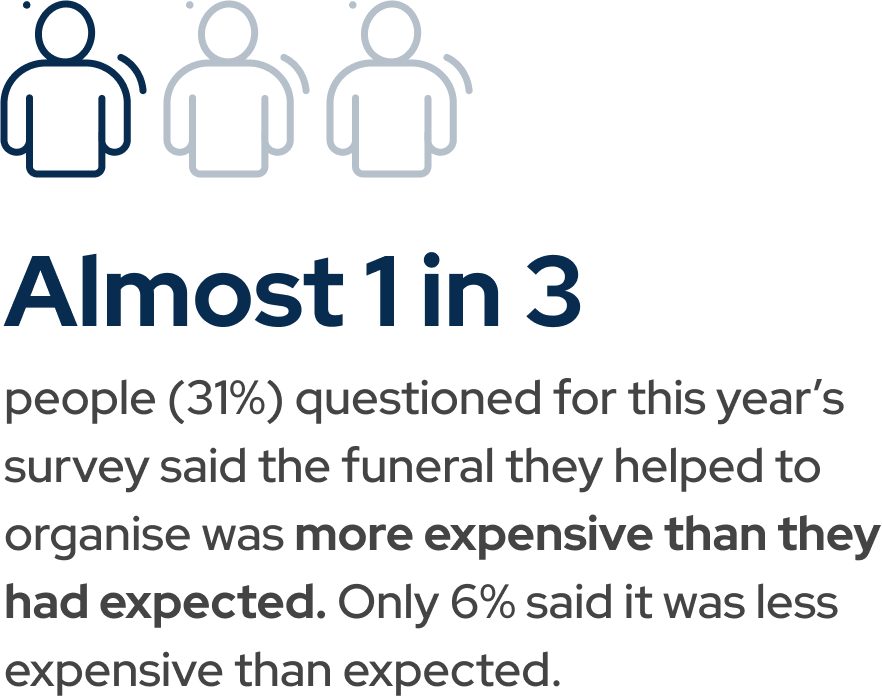

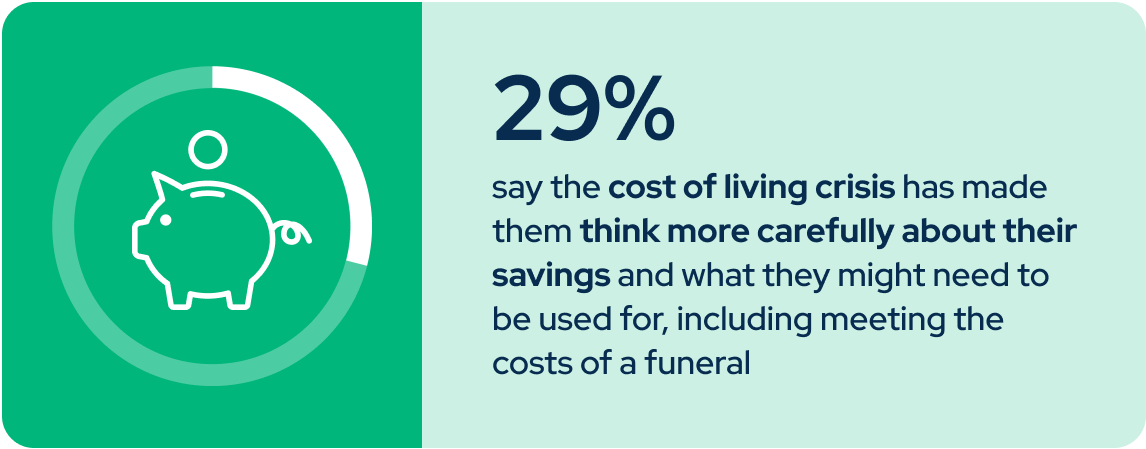

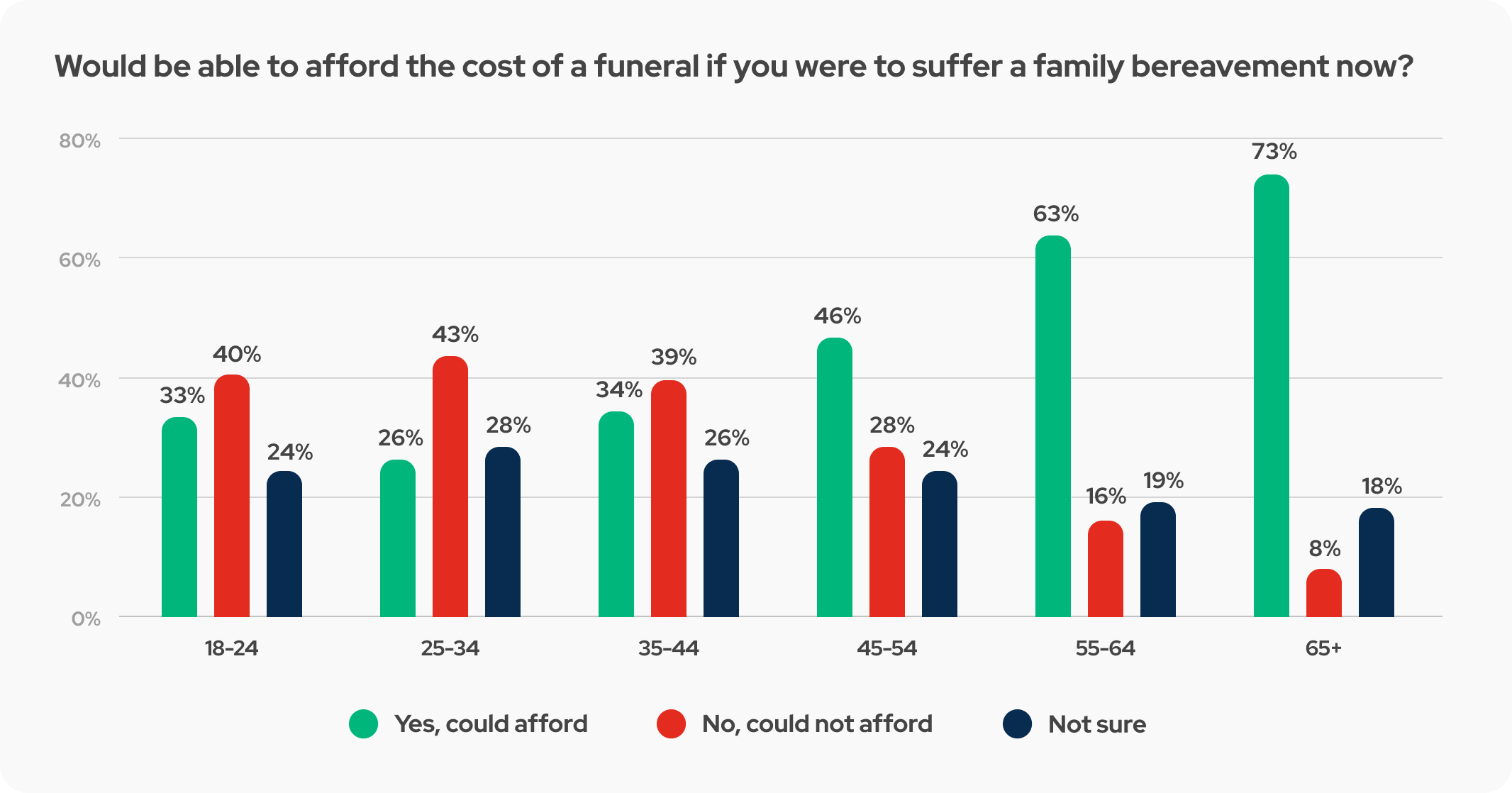

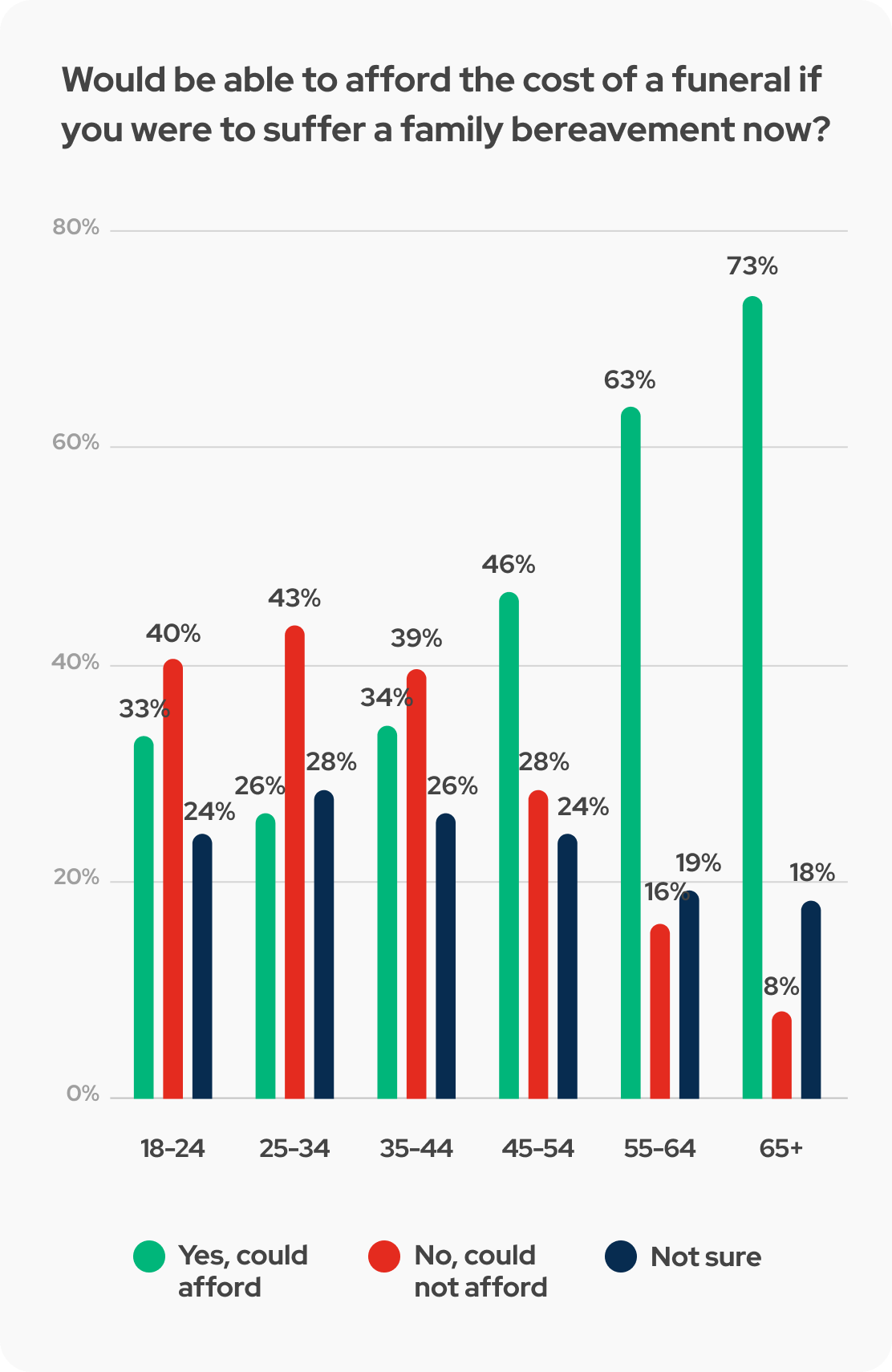

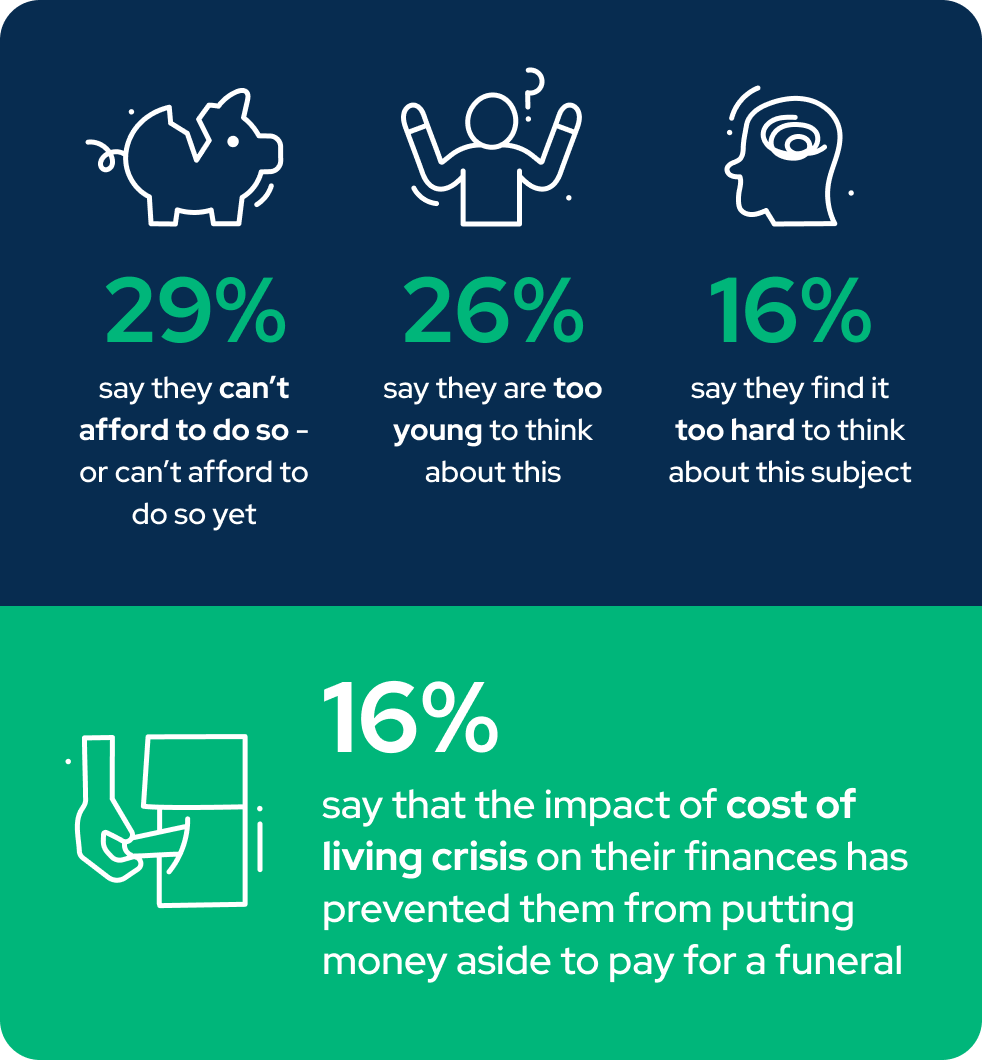

Worries about costs are bound to be more intense for many people at present, as the cost of living crisis continues and a struggling economy means many people are worried about their finances. In that context, the findings of our 2023 Funeral Costs Report underline the importance of planning ahead, to ensure both that practical needs are met; and that the funeral brings some comfort to the family and friends of the deceased.

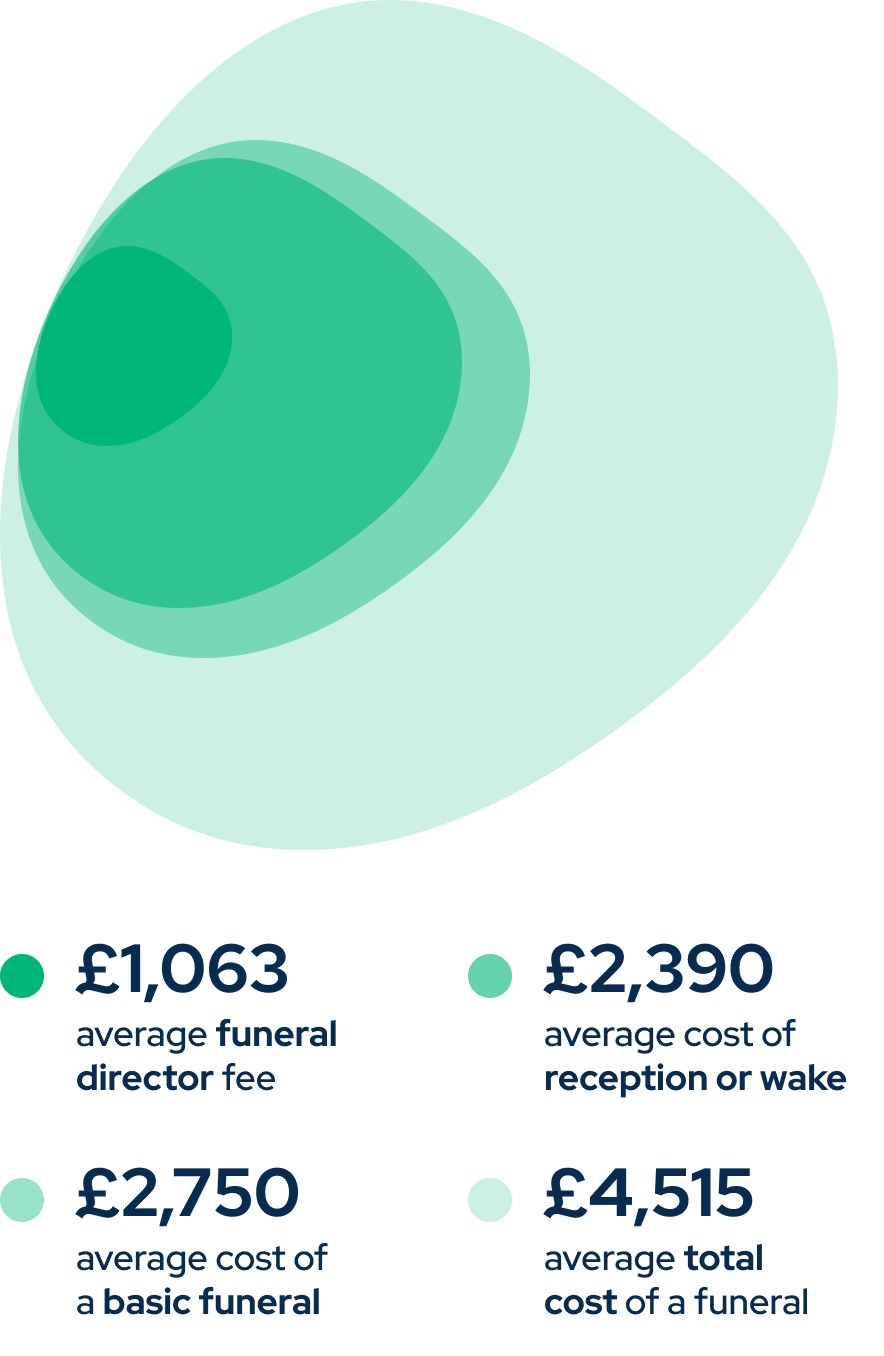

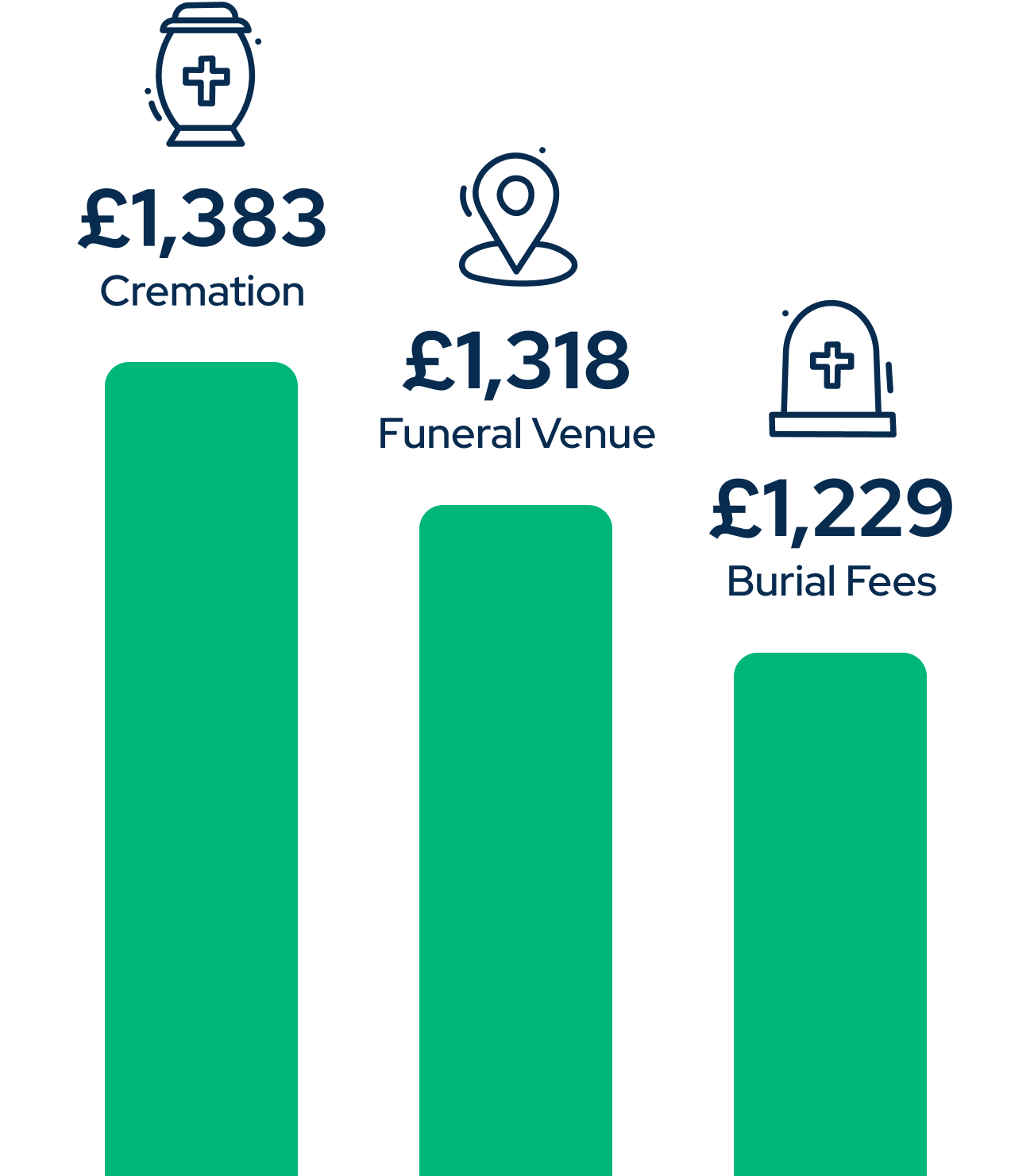

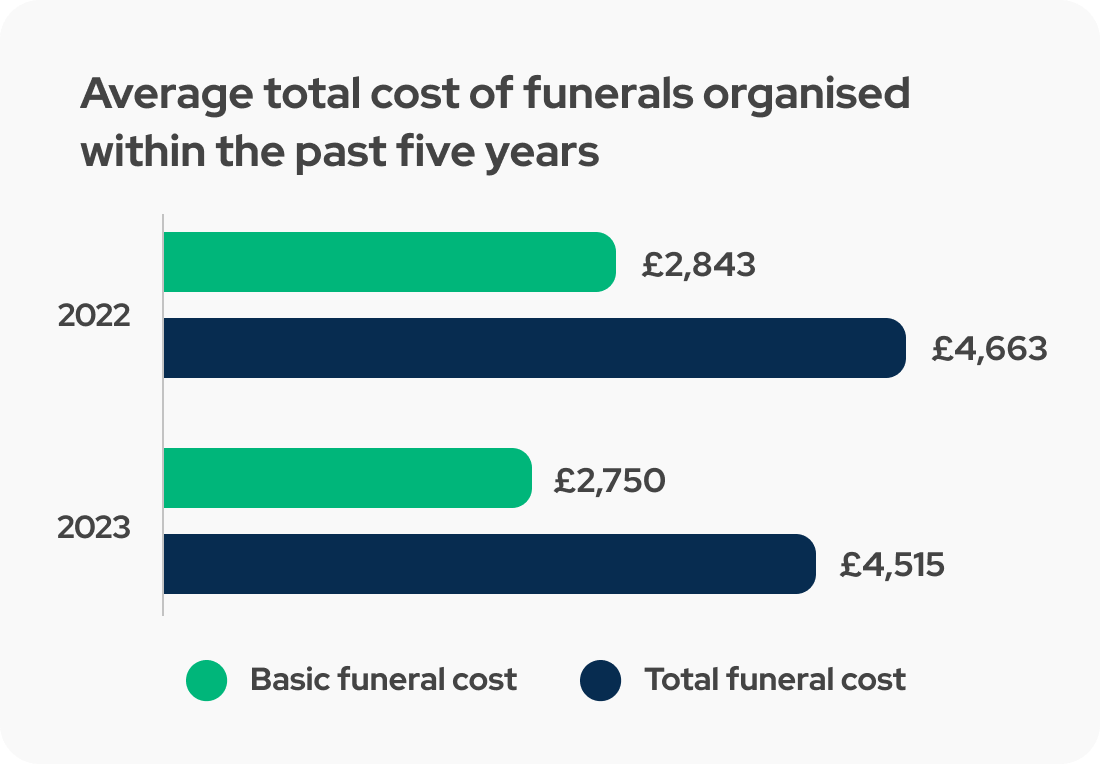

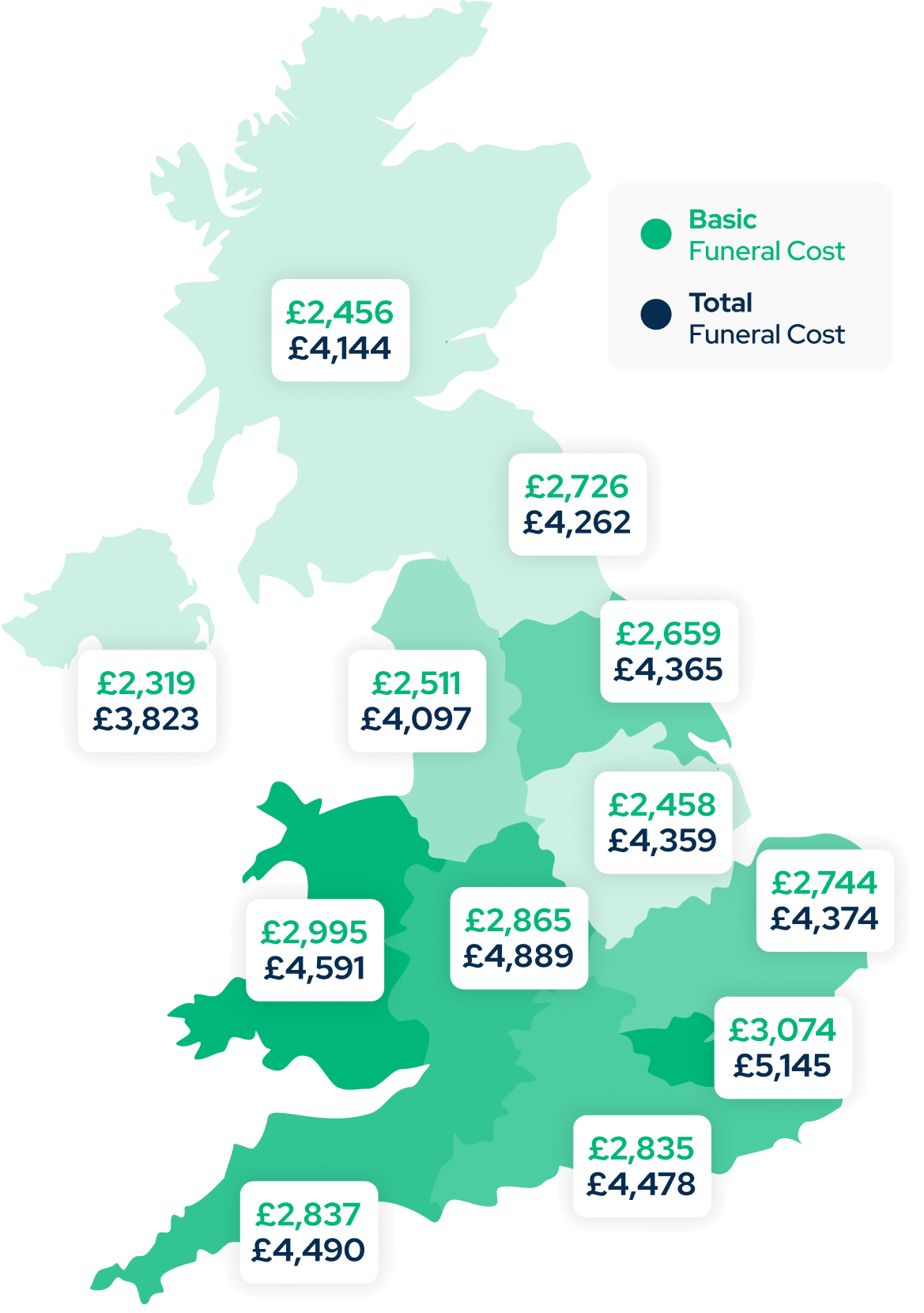

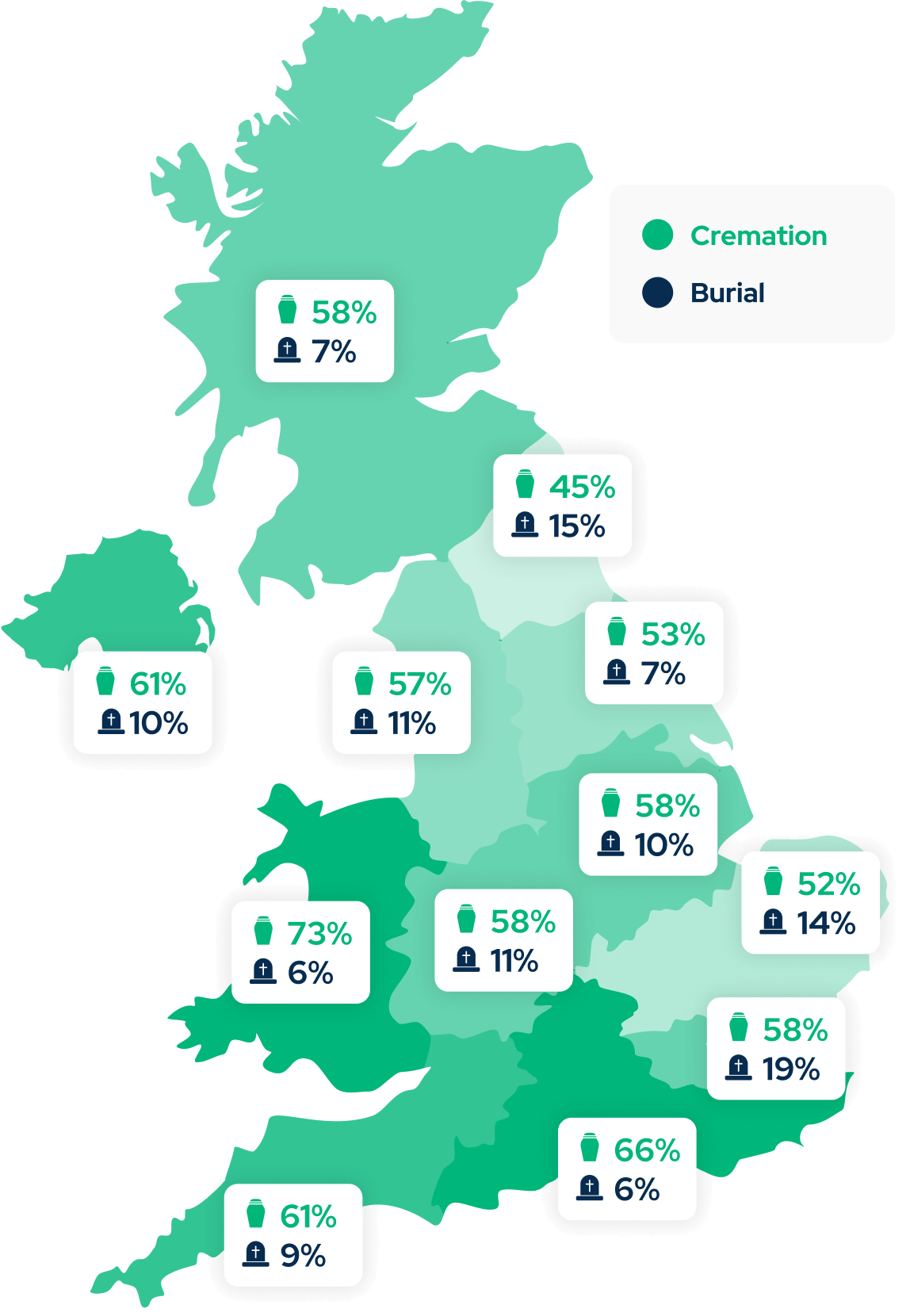

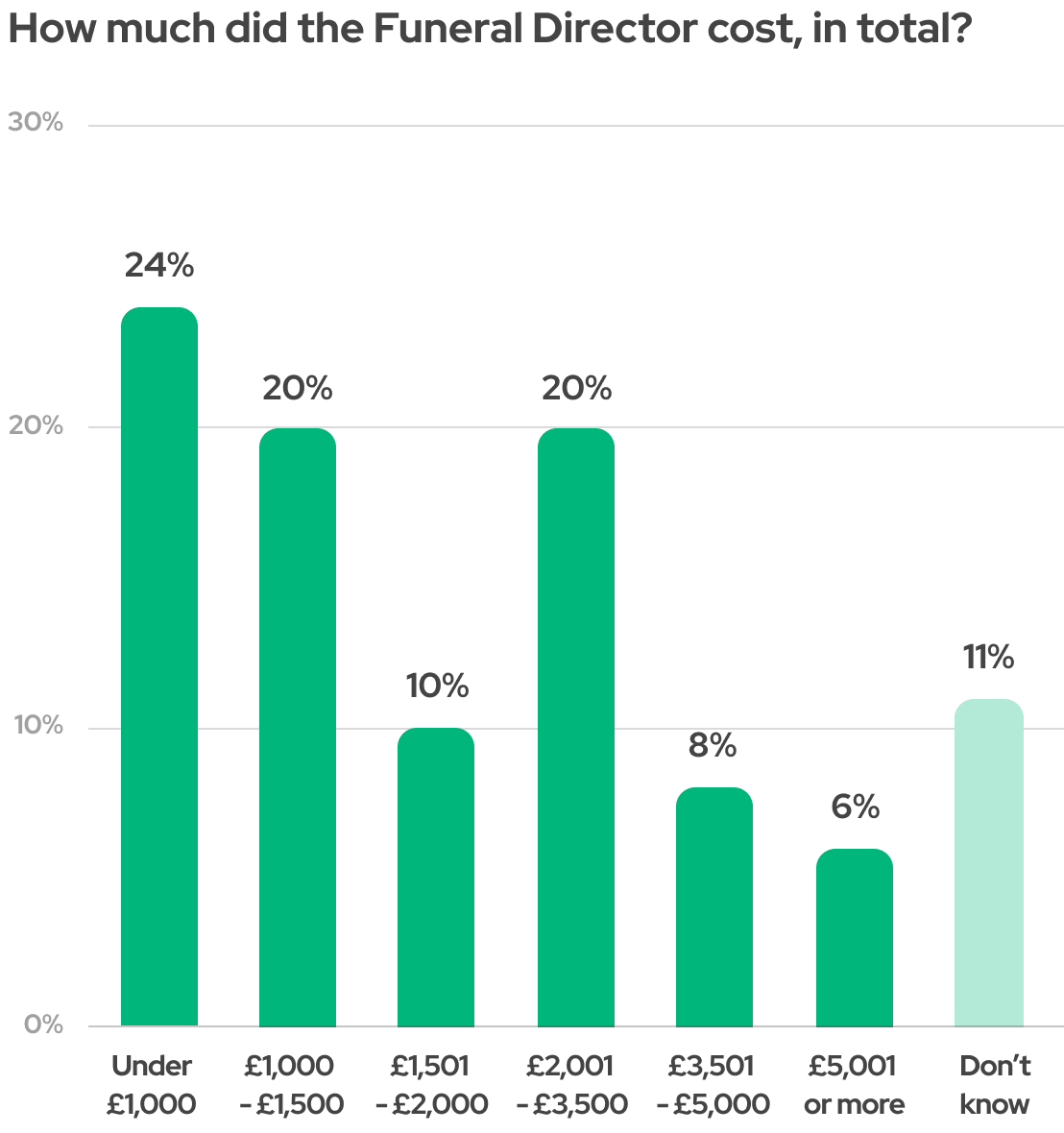

Many of the findings of this year’s report are broadly similar to those seen in previous reports, but it is striking that the costs of many individual elements that might be included within a funeral have been pushed up by inflation. The average total cost of funerals organised within the past five years by people questioned in our Funeral Planning survey was £4,515. But if those additional elements are included average costs could be much higher: they could reach £13,622 for a burial service or £12,668 for a cremation.

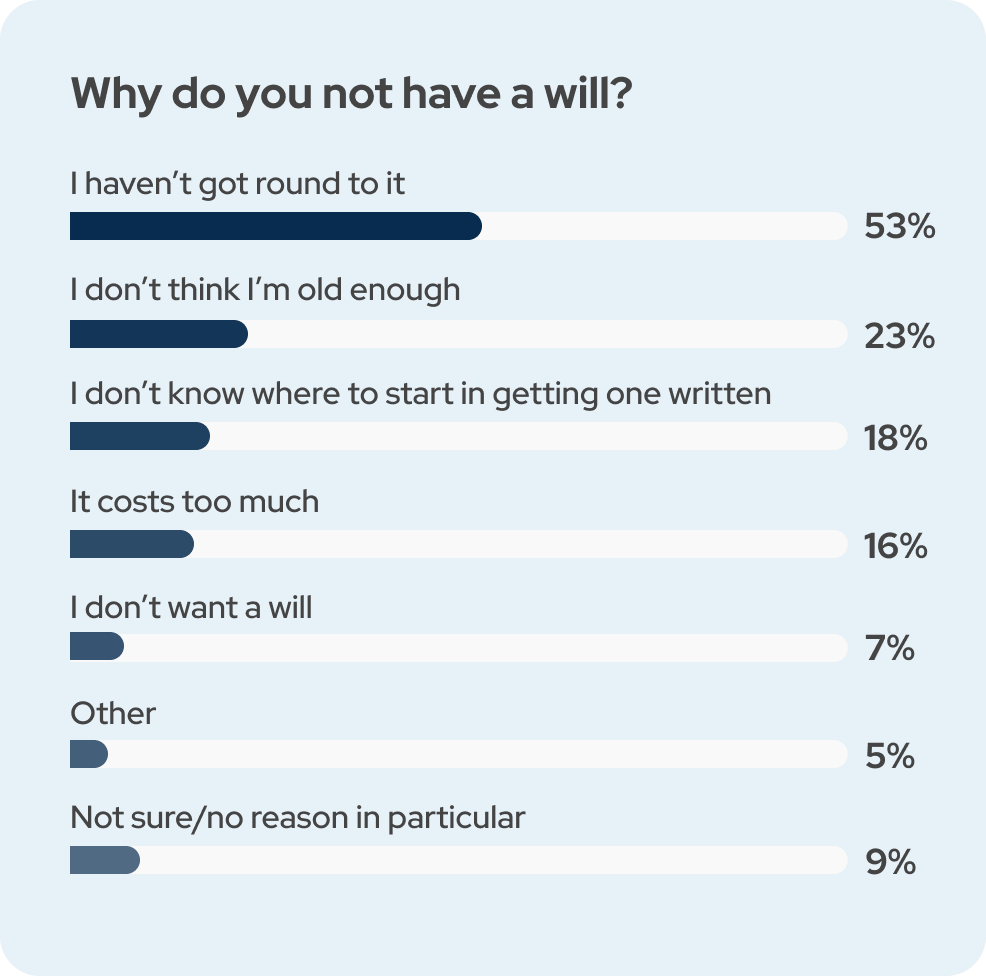

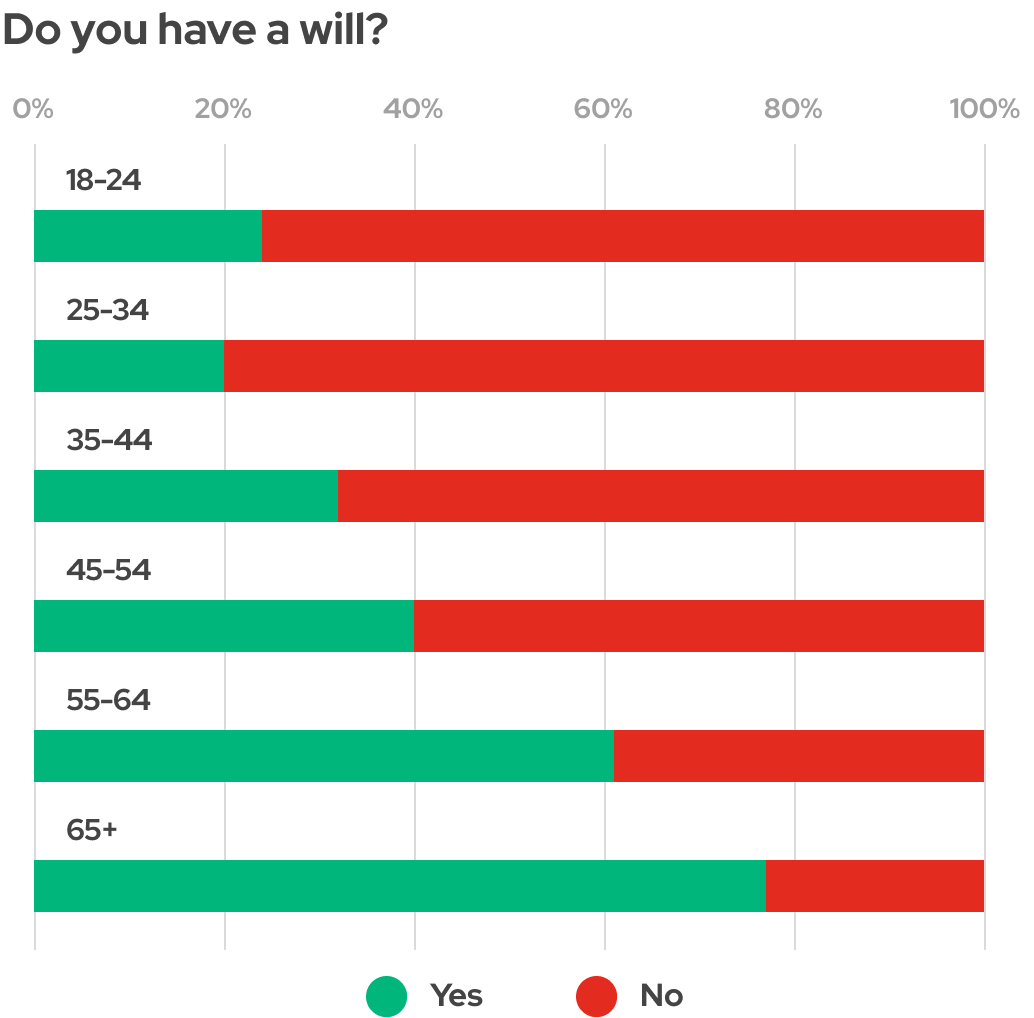

It is also striking that 29% of people surveyed for our Funeral Opinions survey say they have no idea how much a funeral might cost. In part this is because it is so difficult to talk or even think about death, whether anticipating our own death or that of a loved one. Perhaps one of the most worrying findings in this report is that a majority (54%) of people questioned for the Funeral Opinions survey have not yet made a will, including 23% of those aged 65 and over. This may not have an impact on funeral costs, but if someone dies without having made a will it can create enormous practical problems for their families and may also affect how funeral costs are met.

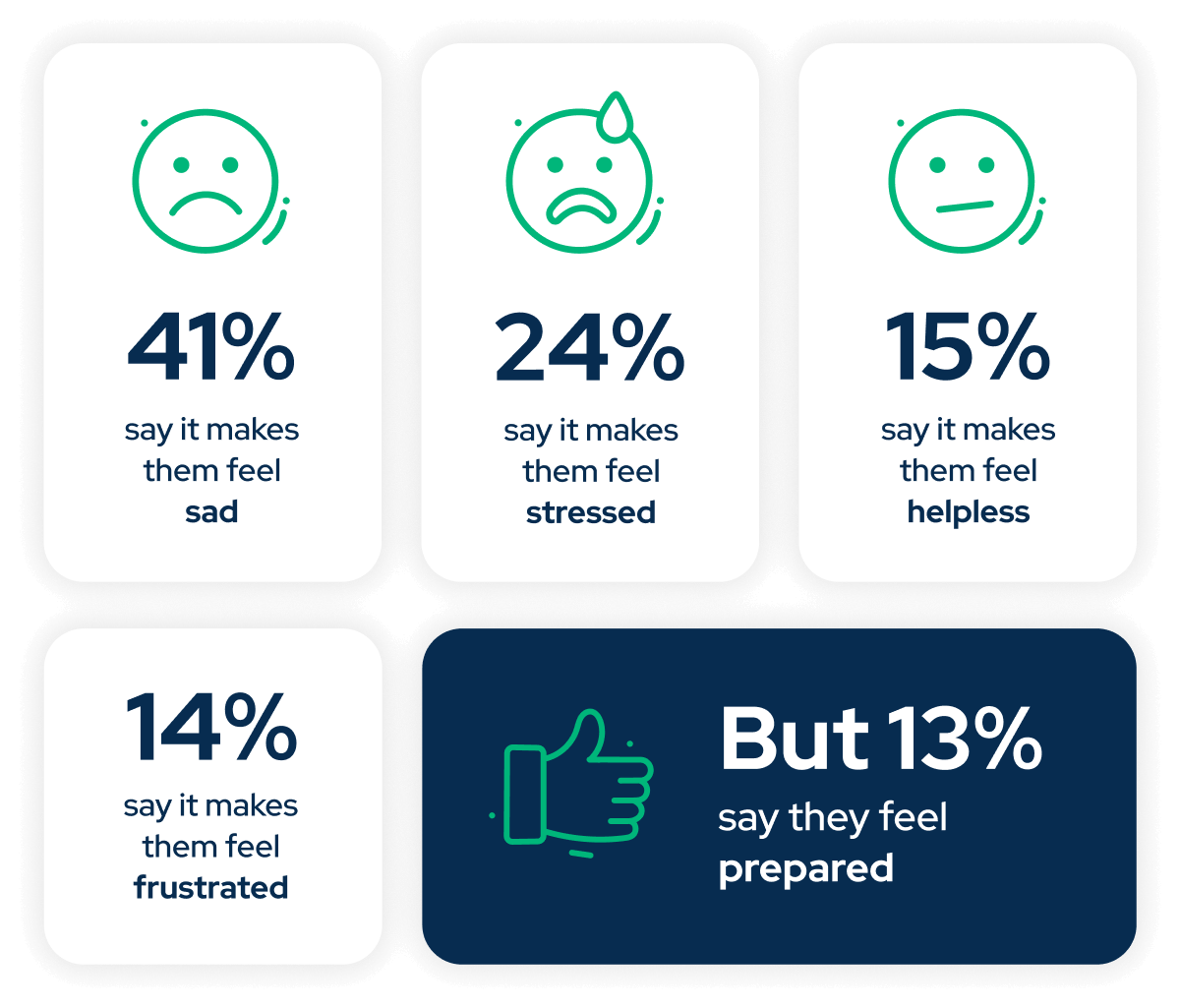

These are difficult issues to face, but, as we have pointed out before, while 41% of people questioned for our Funeral Opinions survey say thinking about the cost of either their own, or of someone else’s funeral made them feel “sad”, we should take note of the 13% who say it makes them feel “prepared”.

Our intention is that this report will provide you with some of the information you need to make informed decisions about your own funeral, or the funeral of a loved one. That way, when the time comes, it is possible to plan and pay for a funeral that offers the best possible tribute to the person who has died – without adding to the difficulties faced by those they leave behind.

We hope you find this report useful.

David Rees

Chief Operating Officer