If you like to keep a close eye on the news, you may already be aware that funeral prices in the UK have reached a point where they are unaffordable for many. These rising costs are potentially pushing some lower-income families into debt.

According to the 2023 British Seniors Funeral Report, the average UK funeral can cost around £4,515 depending on the choices you make. When you add up a list of costs that people may choose e.g., flowers, memorial, catering, the price of a funeral could easily rise to more than £13,000 or more – even with restraint.

Why does location affect funeral costs?

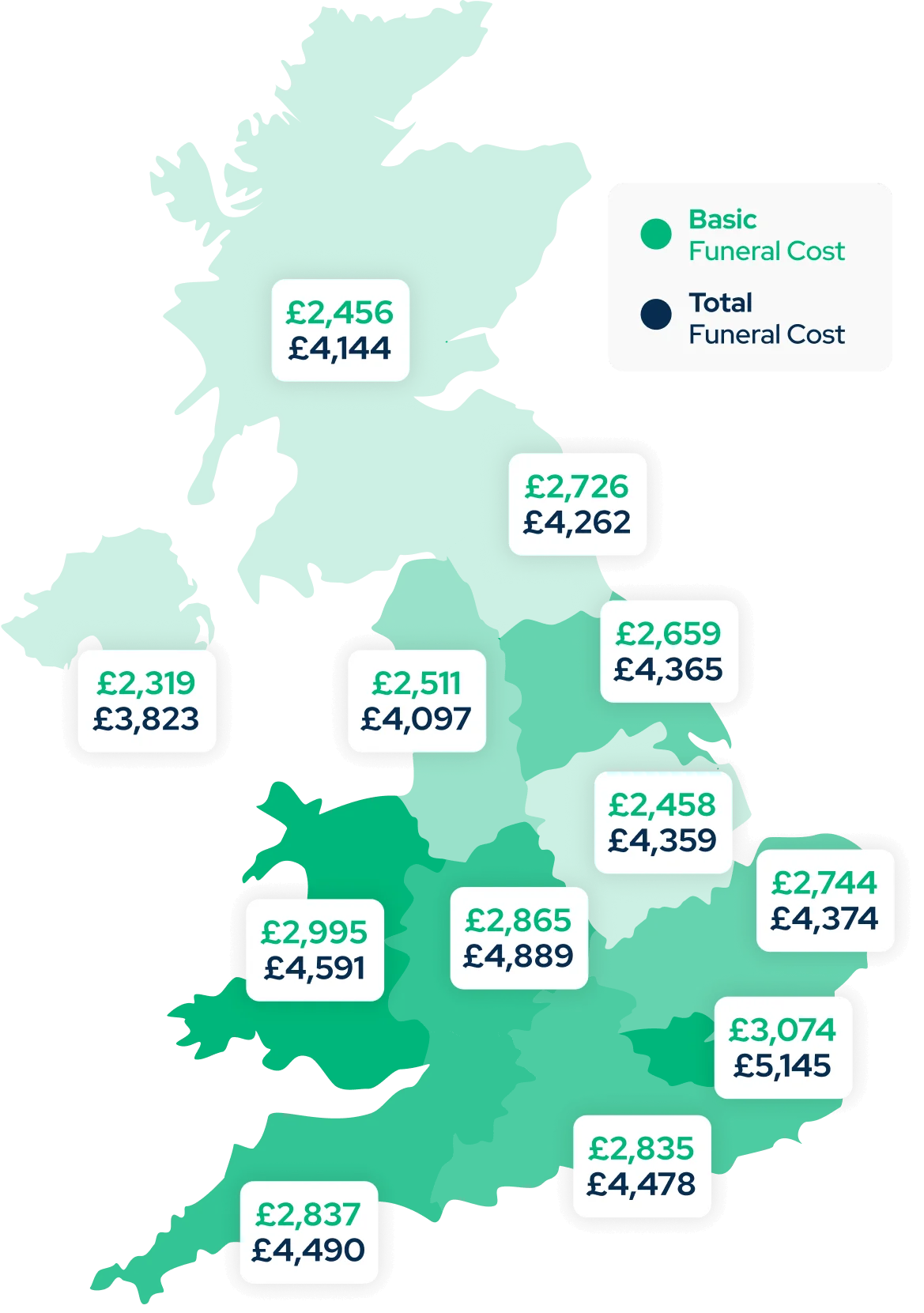

It’s common knowledge that living costs are more expensive in some places than others. But when it comes to burial plots and funeral costs, some towns and cities are exceeding twice the national average. For instance, our 2023 Funeral Report showed that people in London paid £5,145 on average for a funeral. By contrast, the cheapest regions are the East Midlands, where the average price is £4,359, and Northern Ireland, where the average cost is £3,823.

This map from our Funeral Report shows how much the average total cost of a funeral is in various parts of the UK. There's sometimes thousands of pounds in the difference between regions.

While we can’t say for sure what’s driving these prices up, there appear to be several factors at play; one of being that the funeral industry is lucrative and many small, family-owned funeral directors are being replaced with private shareholders.

The Competition and Markets Authority is a government department in the UK, responsible for strengthening business competition and preventing or reducing anti-competitive activities among businesses. The CMA released information they gathered as part of an investigation into the supply of services by funeral directors and the shockingly high cost of a funeral in the UK.

Their Funeral Market Study shows that some larger firms are profiting off something that’s a necessary expense for every one of us at one point or another. We’re running out of room for burial plots. Graveyards, particularly in cities, are at capacity, which could be driving the price up. That’s why many are choosing cremation. As stated by the Money Advice Service, in London (the most expensive place to be buried in the UK) it costs on average £3,282 less to be cremated rather than buried.

How to keep funeral costs down

At times, funeral planning is done in haste as there could be a sense of urgency to get everything sorted. Unfortunately, when we’re grieving the loss of a loved one, we’re at our most vulnerable. We’re not cut out for taking the time to make price enquiries and compare offers. That’s why we tend to go with the first funeral director we come across.

Here’s something to think about: you can save money on a funeral by being informed. Comparing prices and looking into affordable alternatives can prevent you and your loved ones from potentially being ripped off. In fact, according to the CMA ’customers could save over £1,000 by shopping around in their local area’.

People sometimes aren’t aware that there are often more affordable options available to them. For instance, in areas where there are far higher burial costs, you can choose a more basic funeral which may save you thousands depending on your location. On average you could be saving more than a thousand pounds by choosing a basic service no matter where you are in the UK.

Tackling funeral costs with life insurance

Another way to keep costs down is by getting life insurance. By securing a life insurance policy, you’re taking precautions that could help your family in the long run. Your policy could leave money behind that makes a contribution to, or in some cases, cover the entire cost of your funeral. This depends on your age at the start of your policy and your chosen benefit amount.

One of the benefits of securing life insurance is that you have control. You’re taking measures to make sure your loved ones aren’t under as much pressure when the time comes, meaning they’re less likely to lose money or potentially be ripped off.

What to read next:

Find out what could happen if you can’t afford your funeral, so you can put a plan in place to avoid it.